Stamp Duty and Registration Charges in Noida & Greater Noida

Updated on : 07 March, 2025

Image Source: facebook.com

Overview

Noida and Greater Noida are seeing a surge in residential demand, driven by projects like Jewar Airport. If you're planning to buy a luxury home, this article provides a detailed overview of the latest stamp duty and registration charges in these regions.

Image Source: google.com

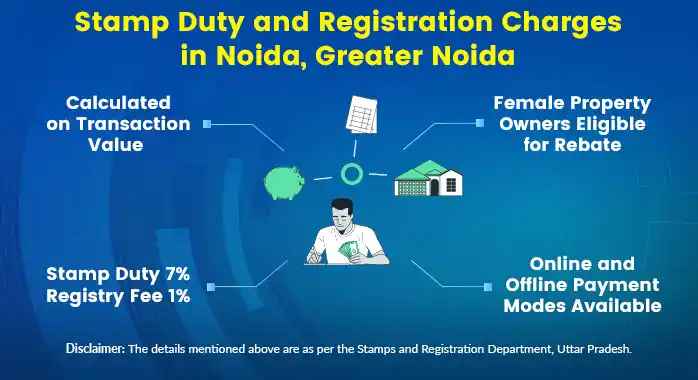

Noida stamp duty rates in 2025

In 2025, Noida stamp duty is 7% for men, with a ₹10,000 concession for women and joint ownership with a female. The registration fee is 1% for all. Here is the table with the latest stamp duty and registration charges in Noida:

| Ownership | Stamp Duty Rates | Registration Fees |

|---|---|---|

| Male | 7% | 1% |

| Female | 7%(minus) Rs 10,000 | 1% |

| Joint (Male & Female) | 7%(minus) Rs 10,000 | 1% |

Stamp duty rates in Greater Noida in 2025

| Category | Stamp Duty Rate | Registration Fee | Notes |

|---|---|---|---|

| Male Buyers | 7% of property value | 1% of property value | No additional concessions. |

| Female Buyers | 6% of property value | 1% of property value | 1% concession up to ₹10 lakh property value. |

| Joint (Male & Female) | 6% of property value | 1% of property value | 1% concession up to ₹10 lakh property value. |

🔗Explore More: Properties near Noida for RENT

Stamp Duty in Noida, Greater Noida for different deed types

I) Stamp Duty for Property-Related Deeds in Noida & Greater Noida

| Type of Deed | Stamp Duty in Noida/Greater Noida |

|---|---|

| Gift Deed | 5% of the property value (₹5,000 if gifting to family members) |

| Will Deed | ₹200 |

| Agreement Deed | ₹10 |

| Exchange Deed | 3% of the transaction value |

| Lease Deed | ₹200 |

II) Stamp Duty for Other Legal Documents

| Type of Document | Stamp Duty in Noida/Greater Noida |

|---|---|

| Adoption Deed | ₹100 |

| Divorce Deed | ₹50 |

| Notary Document | ₹10 |

| Special Power of Attorney (SPA) | ₹100 |

| General Power of Attorney (GPA) | ₹10 to ₹100 |

| Bond | ₹200 |

| Affidavit | ₹10 |

Image Source: google.com

🏡 Don't miss out! Find your ideal commercial property in Greater Noida! 🔥

How to pay stamp duty in Noida and Greater Noida online

Paying stamp duty online in Noida and Greater Noida is easy via the IGRSUP portal, simplifying property transactions for buyers.

Steps to Pay Stamp Duty Online in Noida and Greater Noida

| Step | Description |

|---|---|

| 1. Access the IGRSUP Portal | Visit the official IGRSUP website |

| 2. User Registration | Register as a new user by providing necessary details such as name, email ID, and mobile number. |

| 3. Fill Application Form | Complete the application form with accurate property and personal details. |

| 4. Calculate Stamp Duty | The system will automatically compute the applicable stamp duty based on the provided information. |

| 5. Make Payment | Choose a preferred payment method (e.g., net banking, debit/credit card) to pay the calculated stamp duty. |

| 6. Obtain e-Stamp Certificate | After successful payment, download and print the e-Stamp certificate. |

| 7. Visit Sub-Registrar's Office | Present the e-Stamp certificate and necessary documents at the local sub-registrar's office to complete the registration process. |

🔑 Get exclusive deals on properties in Greater Noida area ! 👉 Explore Now

Finding the nearest Sub-Registrar Office (SRO) is essential for property registration in Noida and Greater Noida

| Sub-Registrar Office | Location | Contact Details |

|---|---|---|

| SRO Noida - Sector 19 | Sector 19, Noida, 201302 | Phone: Not Available |

| SRO Noida - Sector 33 | Sector 33, Noida, 201301 | Phone: Not Available |

| SRO Noida - Sector 62 | Sector 62, Noida, 201309 | Phone: Not Available |

| SRO Greater Noida | G 836, Block G, Gamma II, Greater Noida, 201308 | Phone: 9999001541 |

To locate the nearest SRO:

-

Visit the Official District Website: Access the Gautam Buddha Nagar district's official portal for updated information on SROs.

-

Use Online Maps: Utilize mapping services like Mappls to find precise locations of SROs. For example, the Sub-Registrar Office Campus in Gamma II, Greater Noida, can be located via this link.

-

Contact Local Authorities: Reach out to local municipal offices or real estate consultants for guidance on the nearest SRO.

Documents required to pay stamp Duty in Noida, Greater Noida

| Document Name | Purpose |

|---|---|

| Sale Deed / Agreement to Sell | Primary document for property registration and stamp duty payment. |

| Property Ownership Documents | Proof of seller’s ownership, including past sale deeds or allotment letters. |

| Identity Proof | Aadhaar Card, PAN Card, Voter ID, or Passport of the buyer and seller. |

| Address Proof | Utility bill, Aadhaar Card, or Passport for buyer and seller verification. |

| PAN Card | Mandatory for transactions exceeding ₹5 lakh to verify tax compliance. |

| Power of Attorney (if applicable) | Required if the property is being purchased through an authorized representative. |

| No Objection Certificate (NOC) | Needed in some cases, such as for properties under development authorities like Noida Authority. |

🔗Explore More: Properties near Greater Noida for RENT

Stamp Duty Refund Process in Noida and Greater Noida

| Step | Description |

|---|---|

| 1. Visit the IGRSUP Portal | Go to the official IGRSUP website |

| 2. Register/Login | New users must register, while existing users can log in with their credentials. |

| 3. Fill Refund Application | Complete the refund application form with transaction details and reason for the refund. |

| 4. Upload Required Documents | Attach necessary documents, such as proof of payment, sale deed, and cancellation agreement (if applicable). |

| 5. Submit the Application | Review and submit the application for processing. |

| 6. Verification by Authorities | The submitted details are verified by the concerned authority. |

| 7. Refund Approval | Upon successful verification, the refund is approved and processed. |

| 8. Amount Credited | The refunded amount is transferred to the applicant’s bank account within the stipulated time. |

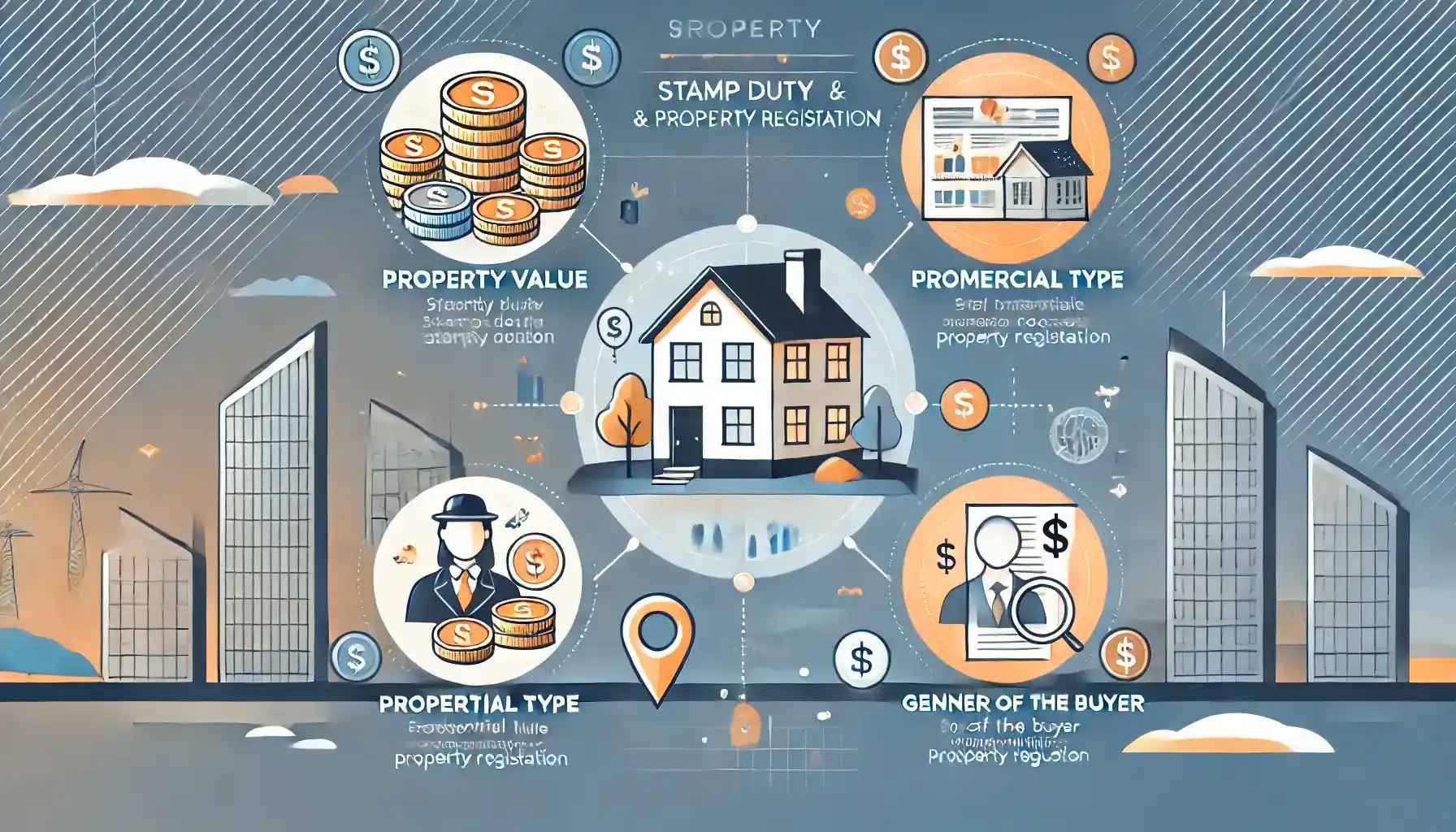

Factors impacting stamp duty in Noida

| Factor | Impact on Stamp Duty |

|---|---|

| Property Type | Residential properties attract lower stamp duty than commercial properties. |

| Property Location | Stamp duty varies based on location; urban areas generally have higher rates than rural or developing regions. |

| Ownership Type | Female buyers get a ₹10,000 concession on stamp duty; joint ownership with a female also benefits. |

| Property Usage | Stamp duty for industrial and institutional properties may differ from residential properties. |

| Property Value | Higher property value leads to a higher stamp duty, as it is calculated as a percentage of the total property cost. |

🔑 Get exclusive deals on commercial plot in Greater Noida area ! 👉 Explore Now

Image Source: google.com

Looking to buy property in Noida? 🏡 Find the best real estate deals now on HexaHome 🔑✨

Government Policies and Concessions on Stamp Duty

The Uttar Pradesh government provides various stamp duty concessions to promote property transactions. Below is a summary of key policies:

| Policy | Benefit |

|---|---|

| Gift Deed Concession | ₹5,000 flat stamp duty for family transfers. |

| Lower Rent Agreement Duty | 2% stamp duty on rental agreements (1 year). |

| Industrial Investment Incentives | Stamp duty exemptions for industrial projects. |

| Tax Deduction (Sec 80C) | Up to ₹1,50,000 deduction on stamp duty paid. |

| First-Time Homebuyer Benefits | Additional tax exemptions on property purchase. |

Note: Policies may change; check official sources for updates. 🚀

Image Source: google.com

FAQs

Que: What is the stamp duty rate in Noida?

Ans: 7% for males, 7% minus ₹10,000 for females.

Que: How to pay stamp duty online?

Ans: Via IGRSUP portal.

Que: What documents are needed?

Ans: Sale deed, ID proof, PAN card, receipt, NOC (if required).

Que: Can I get a refund if the deal is canceled?

Ans: Yes, apply via IGRSUP within six months.

Que: Are women buyers eligible for concessions?

Ans: Yes, ₹10,000 concession on stamp duty.

Que: What is the registration fee?

Ans: 1% of the property value.

Que: Is stamp duty applicable on leasehold properties?

Ans: Yes, based on lease duration and value.

Que: How long does a refund take?

Ans: Typically 15-30 days.

India's Best Real Estate Housing App

Scan to Download the app

Explore Properties for Sale in Greater Noida:

- Apartments for Sale in Sector 12 Greater Noida

- Apartments for Sale in Tech Zone 4 Greater Noida

- Apartments for Sale in Sector 1 Greater Noida

- Apartments for Sale in Jaypee Greens Greater Noida

- Apartments for Sale in Sector 22 Greater Noida

- Apartments for Sale in Sector 4 Greater Noida

- Apartments for Sale in Sector 19 Greater Noida

- Apartments for Sale in Sector 16b Greater Noida

- Apartments for Sale in Chhapraula Greater Noida

- Apartments for Sale in Sector 2 Greater Noida

- Villa for Sale in Sector 16b Greater Noida

- Villa for Sale in Roja Jalalpur Greater Noida

- Villa for Sale in Charpraula Greater Noida

- Villa for Sale in Milak Lachchhi Greater Noida

- Villa for Sale in Tilapata Greater Noida

- Villa for Sale in Sector 10 Greater Noida

- Villa for Sale in Sector 16 Greater Noida

- Builder Floors for Sale in Sector 1 Greater Noida

- Builder Floors for Sale in Bisrakh Jalalpur Greater Noida

- Builder Floors for Sale in Sector 4 Greater Noida

- Builder Floors for Sale in Jalpura Village Greater Noida

- Builder Floors for Sale in Sector 31 Greater Noida

- Office Space for Sale in Sector 4 Greater Noida

- Office Space for Sale in Knowledge Park 5 Greater Noida

- House for Sale in Khera Dharampura Village Greater Noida

- House for Sale in Sector 16b Greater Noida

- Retail Shop for Sale in Sector 16b Greater Noida

- Retail Shop for Sale in Sector 4 Greater Noida

- 1 Rk Studio for Sale in Greater Noida

- Duplex for Sale in Sector 1 Greater Noida

Explore Properties for Rent in Greater Noida:

- Apartments for Rent in Sector 4 Greater Noida

- Apartments for Rent in Sector 16b Greater Noida

- Apartments for Rent in Tech Zone 4 Greater Noida

- Apartments for Rent in Sector 10 Greater Noida

- Apartments for Rent in Phi 3 Greater Noida

- Apartments for Rent in Sector Mu Greater Noida

- Apartments for Rent in Sector 2 Greater Noida

- Apartments for Rent in Sector Pi 1 Greater Noida

- Apartments for Rent in Vaidpura Greater Noida

- Apartments for Rent in Sector 1 Greater Noida

Explore Plots for sale in Greater Noida:

- Plot for Sale Dadri Greater Noida

- Plot for Sale Dhoom Manikpur Greater Noida

- Plot for Sale Sector 17 Greater Noida

- Plot for Sale Sector 12a Greater Noida

- Plot for Sale Amka Greater Noida

- Plot for Sale Patwari Greater Noida

- Plot for Sale Sector 12 Greater Noida

- Plot for Sale Tilapata Greater Noida

- Plot for Sale Sector 4 Greater Noida

- Plot for Sale Gautam Buddha University Greater Noida

Explore PG’s for Rent in Greater Noida:

- PG’s for Rent in Alpha 1 Greater Noida

- PG’s for Rent in Alpha 2 Greater Noida

- PG’s for Rent in Beta 1 Greater Noida

- PG’s for Rent in Tugalpur Greater Noida

- PG’s for Rent in Gamma 1 Greater Noida

- PG’s for Rent in Knowledge Park 2 Greater Noida

- PG’s for Rent in Delta 1 Greater Noida

- PG’s for Rent in Omega 1 Greater Noida

- PG’s for Rent in Knowledge Park 3 Greater Noida

- PG’s for Rent in Knowledge Park 1 Greater Noida

Explore Co-living options in Greater Noida:

- Sharing Room/Flats in Sector 4 Greater Noida

- Sharing Room/Flats in Sector 16b Greater Noida

- Sharing Room/Flats in Sector 3 Greater Noida

- Sharing Room/Flats in Ecotech 3 Greater Noida

- Sharing Room/Flats in Beta 1 Greater Noida

- Sharing Room/Flats in Omicorn 3a Greater Noida

- Sharing Room/Flats in Sector 1 Greater Noida

- Sharing Room/Flats in Tech Zone 4 Greater Noida

- Sharing Room/Flats in Knowledge Park 2 Greater Noida

- Sharing Room/Flats in Sector 2 Greater Noida

Buy, Sell & Rent Properties – Download HexaHome App Now!

Find your perfect home, PG, or rental in just a few clicks.

Post your property at ₹0 cost and get genuine buyers & tenants fast

Smart alerts & search helps you find homes that fit your budget.

Available on iOS & Android

A Product By Hexadecimal Software Pvt. Ltd.